Welcome to my Ultimate Family Frugal Living Guide – with 20 simple tips to save you money! In the UK, there’s definitely been a huge rise in people wanting to take a step back, reflect and change the way in which they live their lives. You might be seeking out a more simple, frugal lifestyle because times are extremely hard, or perhaps you just want to slow down and change the pace. It could be that you want to save money for making memories with the kids; clear debt quickly; renovate your home; or reduce your reliance on material things.

Whatever your motive you’ve come to the right place, and I hope that my guide will help you to save lots of money – you might even find following my frugal living tips fun! (I definitely get a kick out of saving money anyway! 😂) Being frugal doesn’t have to mean going without – we love to travel – think more frugal and thriving! People often ask me how we afford to travel, and the 20 tips that I’m sharing here in my frugal living guide are how we save enough money to fund our adventures. By cutting back where we can, on the everyday stuff, we can spend our hard-earned money on things that will actually add value to our lives.

You can totally live a frugal lifestyle with your kids and still enjoy life – it’s all about setting priorities for your family unit. We live in a chaotic and materialistic world but that doesn’t mean that we can’t choose to step away from it all and embrace a more simplistic lifestyle – reducing stress and saving money along the way. So, I hope that you find my ultimate frugal living guide helpful – here are 20 simple tips to help you and your family save money.

How can I live a more simple frugal lifestyle in the UK?

1. Overhaul your finances

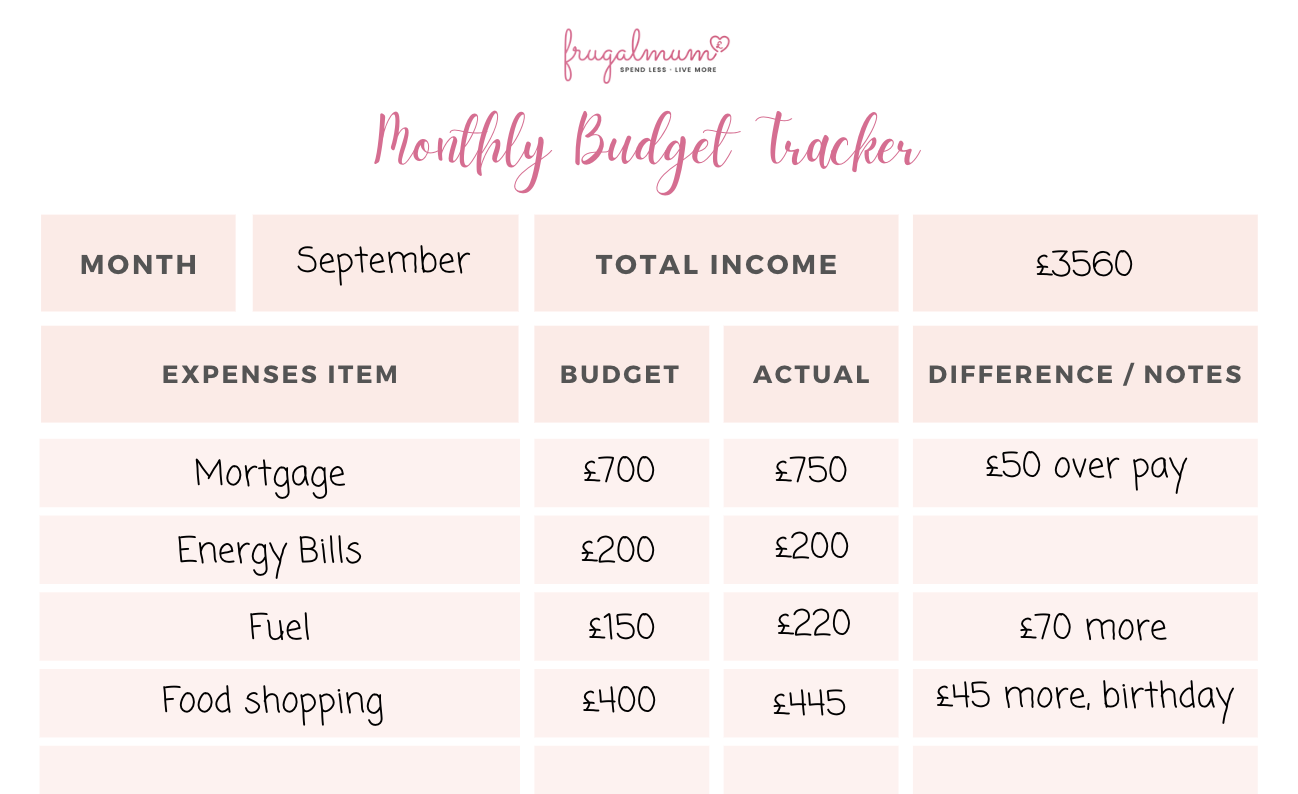

To get started with a more frugal and minimalist lifestyle first look over your finances – you’ll want to create a family budget, avoid unnecessary expenses and switch your focus to spending on experiences and meaningful activities rather than accumulating material possessions. The Frugal Mum motto is – spend less, live more. Before you can begin to transform your finances, you need to spend some time looking at what you have and where your money is going. Collect all of your financial statements including: bank statements, credit card statements, bills, receipts and any other financial documents. This will help you get a clear picture of your current financial situation.

Record all of your expenses for at least two or three months to gain some averages. Categorise expenses into essential spending (like rent or mortgage, utilities, childcare, insurances) and non-essentials (like dining out, subscriptions, clothes). Download my free, printable budget tracker to get started. Look at how this compares to your income and start to set spending limits, budgeting for each area of expenditure. Creating a budget is only half of the battle; actually sticking to it is the real challenge. Track your spending regularly and consider using cash envelopes, spending pots in your online bank account or budgeting apps to help you stay on track.

2. Cancel what you don’t need

Ask yourself whether you need all of your subscriptions, memberships, clubs and activities – are there things that you hardly use or don’t really enjoy? Which things could be cancelled or swapped for a cheaper alternative? For instance: free online classes, going for a run or cycling could replace a £40 monthly gym membership – instantly saving you nearly £500 each year. This applies to the kids too, during the pandemic my children found a love for doing less – there’s so much joy to be had in taking a slower approach to life and spending time relaxing at home is invaluable. Take time to reflect, and then simplify what you have and what you do – living a more simple frugal lifestyle will benefit both your mental health and your finances, whilst freeing up more time too.

Never auto-renew either – make sure that for insurances, and other essential monthly payments, that you’re getting the best deals – reducing your outgoings without a single change to your lifestyle. (And, remember to use cashback websites – the rewards on those sorts of things are usually high!) For us, every penny we claw back can go towards a trip or a day out making memories with the kids.

3. Embrace the ‘no spend challenge’

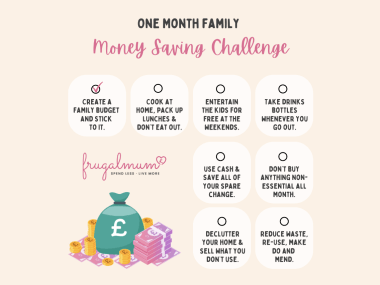

Each month set a ‘no spend challenge’ theme for one area – such as weekends, clothes or eating out – have a different theme each month, so that you don’t miss anything too much. We do this a lot – and it definitely makes you think twice about what you’re spending, whilst encouraging you to be more creative and limit what you’d usually waste on non-essentials. There are lots of other spending challenges too – check out my article: The 12 best family money saving challenges to try today! They’re a great way to keep focussed on your finances, whilst promoting more conscious, frugal and purposeful spending habits. If you want to save quickly, and give your bank account an instant boost, try my one month family money saving challenge.

4. Simplify socialising

According to Nimblefins.co.uk the average household spends around £135 each month on takeaways and restaurants – more than £1600 every year! Try to change the way you see socialising – it’s the people who are important, rather than what you do – you don’t have to miss out, just switch things up. Invite your friend over for a pizza instead of eating out, or share a bottle of bubbly in the garden instead of visiting the local pub. If you usually meet your friends for coffee and cake, why not take it in turns to bake and host it instead?

For celebrations and family gatherings have a big picnic out and about, or hold the party at home. For the kids, my article on how to celebrate your child’s birthday on a small budget is a good place to start! Don’t be afraid to say no either – reducing our social obligations, slowing things down and living a quieter, simpler life can do wonders for our mental health. It’s important to prioritise your family’s well-being so if you won’t enjoy it, you can’t afford it or you just need a rest, politely decline invitations and put yourself first.

5. Invest in re-usable items

Another way to reduce waste, which is great for the planet whilst being really cost effective in the long run, is to invest in re-usable items. When it comes to frugal living, small changes can actually make a big difference – here are a few easy switches:

- Ditch sandwich bags in favour of reusable containers – picnics, packed lunches, leftovers and baked goods can all be stored in reusable tubs.

- Invest in some reusable cotton pads for removing make-up and cleaning up grubby little ones. Prices on Amazon start from around a fiver for a pack of 10-15 large pads – just throw them in with your washing and they’ll be good as new next time you need them.

- Stock up on some reusable water bottles; fill them up before you head out to save money and reduce the need for single-use plastic.

- Use cleaning sprays with washable cleaning cloths to avoid one-use anti-bacterial wipes.

6. Declutter your home

The home is where minimalism and living a frugal lifestyle really overlap – one of the best tips that I can give you is to break it down into manageable chunks (so it doesn’t feel overwhelming) – use my printable 30 day decluttering guide to get started. For most people this will involve getting rid of unnecessary possessions, organising spaces more efficiently with storage that works, and creating a stream-lined, calmer environment. Others may take this a step further and even consider downsizing to a smaller home – it really depends on your lifestyle and personal goals. Letting go of the things that we don’t need is a great way to make life easier and save us time, as well as money.

A ‘less is more’ mindset is great news for your bank balance as you’ll be reluctant to re-introduce clutter into your home – you’ll be wondering where you’ll put each new purchase, how much use it will get and most likely decide not to buy things you don’t need or love. So, simplify the house and have a fresh start. Then donate, recycle or sell the items that you no longer need – you might even have some items that could fetch a decent amount of cash.

7. Connect with nature

Being outside doesn’t cost a penny yet it’s absolutely invaluable for our mental health and well-being. We’re incredibly blessed in the UK to have stunning coastlines, hills and mountains, woodland walks and country parks dotted around for us to enjoy – these are the spaces that help us to feel rejuvenated. Taking pleasure in a hike, a bike ride or a walk along the beach is the definition of a frugal day out – enjoying a more simple, slower pace of life too. We often try to avoid spending money at the weekends, so we spend a lot of time outside whatever the weather and the kids love it! Even when we travel we look for free places to visit like waterfalls, mountains and lakes – and honestly these sorts of days are some of my favourite memories.

8. Do it yourself

Save a small fortune by doing what you can yourself – it may not be perfect but it’ll certainly be cheaper! Learning basic DIY skills for home repairs and maintenance is a great way to save money – and repairing instead of replacing is more eco-friendly too. Sometimes, you’ll need to spend a little on tools to get started (though you can often get these cheaply second-hand) but in the long-run there are so many savings to be made. Instead of buying new we recycle, repurpose and upcycle – some of my favourite pieces of furniture were free – it’s amazing what a lick of paint can do. Upcycling is great way to give your existing old furniture, kitchen cabinets or fitted wardrobes an inexpensive facelift too. I completely transformed our kitchen cupboards for £150.

Save hundreds of pounds each year by rolling up your sleeves and giving things a go yourself. Here are some of the things that we do ourselves to reduce our outgoings:

- Clean the windows – saving around £15 a month / £180 each year. Even if you invest in a pole kit, it’ll soon pay for itself.

- Use our own drain kit to unblock the drains.

- DIY, gardening and decorating the house – only paying for trades when we can’t do it ourselves.

- I cut my husband’s and son’s hair – a good trimmer, some grading scissors and a few youtube videos saves us £30 a month / £360 each year.

- Wash the car.

9. Embrace frugal living habits

Often saving money is about changing old habits, and focussing on the smaller things – as they really do add up. These could be simple changes like renting books from the library instead of buying them, borrowing clothes for a special occasion from a friend, taking a flask of coffee or a refillable water bottle out with you, or packing up a picnic for a family day out. I never leave the house without food and drink – even taking ice-lollies in a cool bag when we head to the park or beach with friends in the summer, or packing a car-picnic if we’re out running errands near lunchtime. The kids are always hungry so it pays to be prepared – and honestly you can’t beat at picnic, especially when you’re travelling!

A small £5 expenditure every day, which may seem insignificant at the time, equates to around £150 each month, or £1800 a year! So look after the pennies and you’ll definitely see the pounds adding up quickly. To keep focussed, set a saving goal for what you’ll use the extra money for instead – simply taking a packed lunch to work each day could fund your entire holiday!

10. Stop buying new

I love thrifting and shopping second-hand – our home is filled with preloved treasures. Selling websites (like Vinted), Facebook Marketplace and social media groups have lots of bargains; from furniture, to curtains, to rugs, to kitchenware, to clothes! So always take a look before you buy new – it’s better for the environment and it could save you a small fortune. There will always be someone selling something that you need for a fraction of what they paid for it – you might even find some freebies. I’ve bought so many things still new and sealed, or clothes with their tags on, buying second-hand doesn’t have to mean you’re missing out.

11. Enjoy frugal family days out

Days out and weekends don’t need to cost a fortune – in fact you often don’t need to spend a penny! Visit a museum, feed the ducks, roam the woods, have a day at the beach or take part in free local activities. For inexpensive fun with the kids, check out my article: 20 ways to have cheap days out with the kids – weekend fun & the school holidays sorted! Or, if you’re local to Kent, you’ll want to check out: Kent with Kids: The 15 best FREE family days out in Kent. Make sure you grab the kids a Blue Peter Badge too, children can gain free entry to over 200 UK attractions around the country such as theme parks, zoos and castles – making those bigger days out a lot more affordable. To find out how your children can apply, check out my article on Blue Peter Badges.

12. Reduce your waste

In the UK, we throw away a shocking 7 million tonnes of food and drink per year! Not only is this bad news for our bank balance, it’s also awful for the planet. A recent article reckoned that the average British household bins more than £65 worth of food every month – almost £800 annually – time to book a holiday instead! Soups, sauces, quesadillas and curries are great ways to use up any leftovers. But reducing waste doesn’t just apply to food – have a go at repairing broken appliances, mending holes in clothes and repurposing what you have.

13. Change the way you eat

Frugal shopping and cooking, reducing your food costs by just £20 a week, will save you over £1000 every year – plus you’ll likely be eating in a more healthy and sustainable way too:

- Avoid expensive and unhealthy processed foods by cooking from scratch.

- Use the Olio app to reduce your food bill and become a food waste hero – collecting food shopping for free!

- Batch cook to fill the freezer to save you time in the future.

- Freeze and preserve what you grow in the summer, to enjoy later in the year.

- Use frozen vegetables and herbs to save money, prep time and reduce waste.

- Plan your meals in advance to reduce food waste and avoid unnecessary spending on takeout or dining out.

- Buy items in bulk and take advantage of discounts to reduce costs.

- Love your leftovers.

- Buy some seeds (or get some from a local seed swap) and grow your own fruit and veg.

- Ditch branded items in favour of stores own brands to slash your food bill by up to 30%!

14. Rethink your beauty routine

Brow tints, facials, waxing and all sorts of other expensive treatments can soon add up. Take the time to reassess what you can do without, and what you can do at home yourself. Simply painting your own nails could save you £20 a month. And, colouring your own hair, or using a root touch-up kit to extend the time between expensive hair appointments, could save you hundreds of pounds each year. Little things, like heating your mascara tube with the hairdryer to make it last longer or chilling your nail polish in the fridge to prevent clumping, can make a difference too. And, look out for budget-friendly products – my favourite wax strips are just 99p (Vital from Home Bargains!) and I absolutely love Aldi Lacura Face Wash – there are plenty of affordable good quality products to be found.

15. Reassess your luxuries

Similarly, you might want to reassess other luxuries and non-essentials too. For instance, you could ditch expensive TV packages in favour of Netflix or Amazon Prime. Or, opt for a lesser mobile phone contract – ask yourself what these expensive things actually bring to your life. Switching to an older model or SIM only deal can also save you enormous amounts of money. It’s easy to find a SIM only deal for less than £10 each month – whilst the average phone contract is upwards of £30 per month – this switch would save around £240 per year depending on your contract costs. Cutting back on a few luxuries could help you to save for something fun, like a weekend away or a holiday abroad so keep that it mind – spending less on ‘stuff’ might allow you make more memories and live a fuller, happier life.

16. Improve energy efficiency

Save on utility bills by being mindful of energy consumption, making a few easy changes and insulating your home. It could be as simple as choosing to sweep instead of using the hoover, waiting for a bright day to dry washing outside and wearing some extra layers before turning up the thermostat. Turning the heat down by just 1 degree could reduce your heating bill by 10%! According to the Energy Saving Trust, we can also save £65 each year by just remembering to turn off the appliances that we’re all guilty of leaving on standby. And, another £25 by remembering to turn the lights off when we leave a room.

17. Have a minimalist Christmas

Christmas and other celebrations can really make a dent in our bank balances. The good news is that it doesn’t have to be crippling if you make a few changes. First, set a budget (and stick to it) and put money away year round. Then, simplify where you can – focussing on what Christmas is really about makes it totally do-able without much money. Avoid unnecessary gifting and remember to embrace second-hand shopping too, or think about which gifts you can make yourself! Don’t ditch your frugal living goals for the festive season – I’ve got loads of tips for an affordable minimalist Christmas – check out my guide: Christmas without money – 30 tips for a DIY family Christmas on a small budget.

18. Cut motoring costs

To slash fuel and maintenance costs, think about which short journeys could be walked or cycled. For longer journeys, could you use public transport, or car share with friends on the school run or colleagues for work? According to liftshare.com, car sharing could save you up to £1000 each year in fuel costs. But, when you do need to fill the tank, visit a website like petrolprices.com to quickly compare fuel prices near you. If you work from home, it’s also worth considering if your household needs more than one car. It’s not just the fuel that adds up but insurance, services, MOTs and repairs too. We sold our second car, and it saves us around £1000 per year. But, if you need your wheels, perhaps think about downsizing to a more fuel-efficient model if need be.

19. Travel frugally

This year a summer holiday might seem impossible, but with a little bit of creativity, it might just become a reality. Perhaps you could book a Sun Newspaper Holiday for just £9.50 per person; join Trusted Housesitters; or go camping to slash accommodation costs. Maybe you could travel completely out of season? Or swap flights for a road trip? Eurocamp have some incredible deals – if you need an affordable school holiday break, I recently found 78 family holidays under £250 for May half-term week, we’ve had some incredible Eurocamp road trips on a budget – spending as little as £25 per night.

Frugal living doesn’t mean going without, just switch up what you do (I’ve got so many money-saving travel tips on the blog) – and these two guides are probably the best place to start. The more you save the more you can travel, so take a look at my articles: UK family travel on a budget: 25 ways to have a cheap staycation holiday! and Budget Family Holiday Tips: How to travel in Europe cheaply with kids for tips on keeping your holiday costs down.

20. Change your shopping habits

Be mindful of your shopping habits to avoid impulse buying and unnecessary purchases. Focus on the essentials, so that you buy only what you truly need, and think quality and longevity over quantity in order to save money in the long run whilst shopping in a more sustainable and eco-friendly way. At times that might even mean spending a bit more on a good quality piece of clothing, or furniture that will stand the test of time, rather than ‘cheap and cheerful’ things that will need replacing shortly after. But, if you’re buying less of everything, you’ll likely be able to spend a little more on the important things.

What does frugal living mean?

Living in a frugal way doesn’t mean that you have to go without, nor live a boring lifestyle, you’re simply saving money on the things that you don’t value in order to redirect that money towards the things you really want or need. I hope that my guide on how to save money by living in a more simple frugal way has been helpful – if you have any more tips of your own let me know in the comments! Frugal living with kids isn’t always easy but try to involve them in the process and set goals as a family to keep you all on track.

And, I promise that living in a frugal way is so worth it – as I’ve mentioned throughout this guide, small changes can have a huge impact on your finances – start by focussing on just a few of my tips and you’ll soon see a difference in both your bank balance and your spending habits. Spending just £10 less each day would leave you with an extra £3650 each year for having a good time.

The best way to see significant change is to really re-evaluate your lifestyle. Ask yourself what you really need and what you value the most. Could you downsize to a smaller house to reduce your mortgage payments and have more cash for the fun things in life? Or, perhaps you could go a year without new clothes to fund a holiday instead. Being frugal goes hand-in-hand with a more simple, minimalistic lifestyle, and this means changing your mindset entirely. It’s not about missing what you don’t have, or feeling hard done by when you go without. You’re choosing this and, for everything that you let go from your life, you’re gaining so much more…. Time. Money. Energy. Happiness. Memories.

Tomorrow is not a given. When we start to see the world in a different way, and our perception of value changes, we can finally appreciate what’s really important. Develop a mindset of gratitude for what you have – taking time to appreciate the simple pleasures in life. When we stop feeling defined by our possessions, they stop holding us back. When we live in an economical way, and prioritise our spending on needs over wants, it allows us to afford the things that we love, avoid debt and reach our long-term financial goals.

It’s usually just simple choices, for instance: opting to pack a lunch or cook a meal instead of eating out; using up leftovers; shopping second-hand; or spending your weekends hiking or playing at the beach instead of doing expensive activities. For us, when we avoid spending money unnecessarily on these kinds of things, it allows us to: travel for longer and more often; fund our home improvements; and overpay on our mortgage (debt free is the dream!). Redirecting our money towards things that will actually enhance our lives and make us happy, instead of everyday things, is really what frugal living is all about. Good luck!

Follow my tips and download my free printable guide: 25 ways to live a simple, frugal lifestyle to help with your frugal living journey.

This post may contain affiliate links – I may earn a small commission at no additional cost to you.