This post may contain affiliate links.

Are you tired of living paycheck to paycheck, struggling to make ends meet, or feeling like your money just disappears into thin air? If so, it’s time to take control of your finances and create a family budget that works for you.

Saving money and budgeting when you have a family requires careful planning, discipline, and making smart financial decisions. There’s no avoiding the added costs that come with having children, nor that you’ll also be shorter on time too, but there are simple ways to help you save money while managing your family’s finances – get the kids involved too!

A well-thought-out budget can help you achieve your financial goals, create financial stability, reduce stress, and ensure that you’re making the most of your hard-earned money. So set aside some time to follow these steps to create a successful family budget, understand your finances and save money:

1. Create a Budget:

Start by tracking your income and expenses – you can’t spend and save effectively if you don’t have a good idea of how much you’re spending and on what. Here’s how to create a budget:

- Step 1: Set Clear Financial Goals: Before you dive into the nitty-gritty of budgeting, take some time to define your financial goals and priorities. Do you want to pay off debt, save for a holiday, buy a new car, or build an emergency fund? Having clear goals will give your budget purpose and motivate you to stick with it.

- Step 2: Gather Financial Information: Before you can begin to transform your finances, you need to spend some time looking at what you have and where your money is going. Collect all of your financial statements including: bank statements, credit card statements, bills, receipts and any other financial documents. This will help you get a clear picture of your current financial situation.

- Step 3: Calculate Your Income: List all sources of income for your family. This includes your salary, your partner’s income, any benefits, side hustle earnings, and any other money that comes into your household on a regular basis.

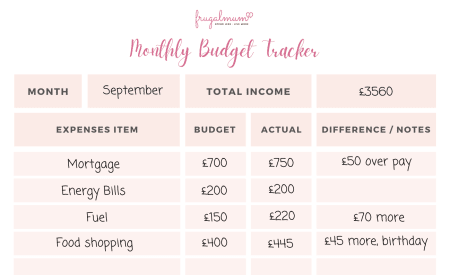

- Step 4: Track Your Expenses: Record all of your expenses for at least two or three months to gain some averages. Categorise your expenses into essential spending (like rent or mortgage, utilities, childcare, insurances) and non-essentials (like dining out, subscriptions, clothes). Download my free, printable budget tracker to get started.

- Step 6: Set Spending Limits: Determine how much you want to spend in each category based on your financial goals and your previous spending habits. Be realistic and prioritise essential categories like savings and debt repayment. Now that you know where your money has been going, read my article: How can I live a good life in the UK with little money? 25 tips for living a simple, frugal, minimalist lifestyle! to see which areas you can cut back on. My advice is always to try and save on the boring stuff (like food shopping) so there’s more in the kitty for fun!

- Step 7: Stick to Your Budget: Creating a budget is only half the battle; sticking to it is equally important. Track your spending regularly and consider using cash envelopes, spending pots in your online bank account or budgeting apps to help you stay on track.

- Step 8: Review and Adjust Regularly: Your financial situation and goals will change over time – particularly as your children grow and their needs change. Periodically review your budget to ensure it aligns with your current priorities and expenses, and adjust it as needed.

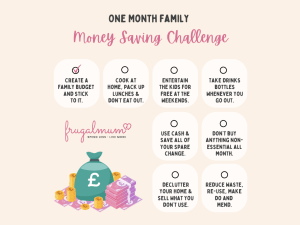

2. Cut Unnecessary Expenses:

Identify non-essential expenses that can be reduced or eliminated. This might include eating out less, cancelling unused subscriptions, or finding cheaper alternatives for certain products and services. Taking on a spending challenge, such as the No Spend Challenge, is a great way to tackle reducing the non-essentials – take a look at this post for more info on spending challenges: The 12 best money saving challenges to try today!

3. Meal Plan:

Plan meals in advance, make a shopping list, and stick to it – using your leftovers too. Cooking from scratch at home is usually more cost-effective than dining out or ordering takeout, especially when you’ve got lots of mouths to feed. Don’t forget to plan snacks, and what you’ll need for weekend picnics too, so that you’re not spending more than you need to on days out. Read: How to save money on food shopping: 20 easy ways to cut the cost of your food shop for lots of ways to save on food.

4. Use Coupons and Discounts:

Buying bits for your kids – like clothes, toys and school things is unavoidable – they grow, things break and even if you go for a ‘less is more’ approach, they still need a certain amount of things. So, take advantage of coupons, loyalty programs, cashback sites and seasonal sales and discounts when shopping. Many stores offer digital coupons or loyalty apps that can save you money.

5. Buy in Bulk:

Purchase non-perishable items – such as toilet paper, cleaning supplies and store-cupboard bits – in bulk. It’s usually much cheaper to buy large bags of rice etc, and even better when they’re part of a promotional offer. With a family, you’ll soon get through it all, so if you can store some bulk items you’ll certainly save some money.

6. Reduce Energy Costs:

Energy costs are crazy at the moment, but you can save on utility bills by using energy-efficient appliances, turning off lights when not in use (and replacing bulbs with LED), sealing drafts in your home, and turning the heating down a degree or two. My kids also love hoodie blankets – heating the person before heating the home is a great way to cut costs. For lots of ideas check out: 20 simple ways to reduce your energy bills and save money.

7. Limit Impulse Purchases:

Avoid making impulsive purchases by setting a spending limit for luxuries and non-essential items, and waiting 24 hours before buying something you don’t actually need. Curb unnecessary spending by asking yourself: How much use will it get? Do I need it? Do I love it? Will it improve my life?

8. Create an Emergency Fund:

Build an emergency fund to cover unexpected expenses, such as job loss, broken dishwashers and car repairs. This will help you to avoid debt (and interest repayments!) if something doesn’t go to plan – aim to save a few month’s worth of living expenses if you can.

9. Prioritise Saving:

Treat savings as a non-negotiable expense in your budget, allocating a portion of your income to savings before allocating funds to other expenses. If possible, set up automatic transfers into your savings account to consistently save money without having to think about it. That way you won’t be tempted to spend it, and you’ll have some cash when you need it, or fancy treating the kids.

10. Consolidate Debt:

If you have multiple high-interest debts, consider consolidating them into a lower-interest loan or credit card. This can reduce your overall interest payments and make it easier to manage. If things have gotten out of hand, seek professional advice – there are ways to reduce what you owe and make things more manageable.

11. Reduce Transportation Costs:

We both work from home so sharing one car saves us thousands of pounds every year – if you can, that might be something to consider. As well as this, if possible, look at carpooling for the school run, work or kids clubs; take advantage of transportation deals (like kids for a quid); or bike / walk when possible to save on fuel and maintenance costs.

12. Have Frugal Fun:

Making memories is so important so don’t go without, just enjoy cheap days out and travel on a budget – be creative where you can to make the money stretch. Maybe you could housesit, camp, take a road trip or travel out of season?

For lots of travel ideas, take a look at my posts Travelling abroad on a budget – 25 ways to save money on your family holiday! and UK family travel on a budget: 20 ways to have a cheap staycation! And, for days out, you’ll find loads of ideas here: How to have cheap UK days out – family fun on a budget!

13. Stop Buying New

Selling websites and social media pages have lots of bargains; from furniture, to curtains, to rugs, to kitchenware, to clothes! So always take a look before you buy new – as well as it being better for the environment, it could save you a small fortune. And, don’t forget to consider mending, upcycling or repurposing what you have already too.

14. Educate Yourself:

To get the most from your money, educate yourself and your family about personal finance. The more you understand money management, the better equipped you’ll be to make informed decisions, and it’ll really help the kids when it’s time for them to stand on their own two feet.

To get started, check out my article: A guide to interest rates, savings & clearing debt quickly. Should I pay off debt, save money or enjoy life? The four part financial guide covers:

- Part One: A guide to understanding debt and key financial terms: Looking at interest rates, APR, savings and how debt can accumulate. Debt can be overwhelming – it’s crucial to make sure you have a good idea of what you’ll be expected to repay on any borrowing. The more knowledge we have, the more equipped we are to make good financial choices.

- Part Two: With the current high interest rates, should I pay off debt or save money? (Or just enjoy my life!) Exploring whether it’s best to pay off debt, save money or just enjoy life – the financial balancing act!

- Part Three: Why is saving money so difficult? (And what you can do to overcome it!) Understand what might be preventing you from getting on top of your savings. By identifying any problem areas, you’ll be able to get your finances back on track in no time.

- Part Four: How can I clear my current debt quickly? Exploring ways to clear existing debt quickly, change future spending habits and boost your income – to redirect even more cash towards gaining financial freedom.

15. Adopt a simple, frugal lifestyle:

To really make a change to your family life and finances, try to look at even more ways to live a more simple, frugal lifestyle. For lots of tips to help you to save money, reduce stress, clear debt and save time – you’ll want to check out my article:

The Ultimate Family Frugal Living Guide: 25 simple tips to save you money!